The basic role of our company is mainly Coordinating and Counselling.

The basic role of our company is mainly Coordinating and Counselling.

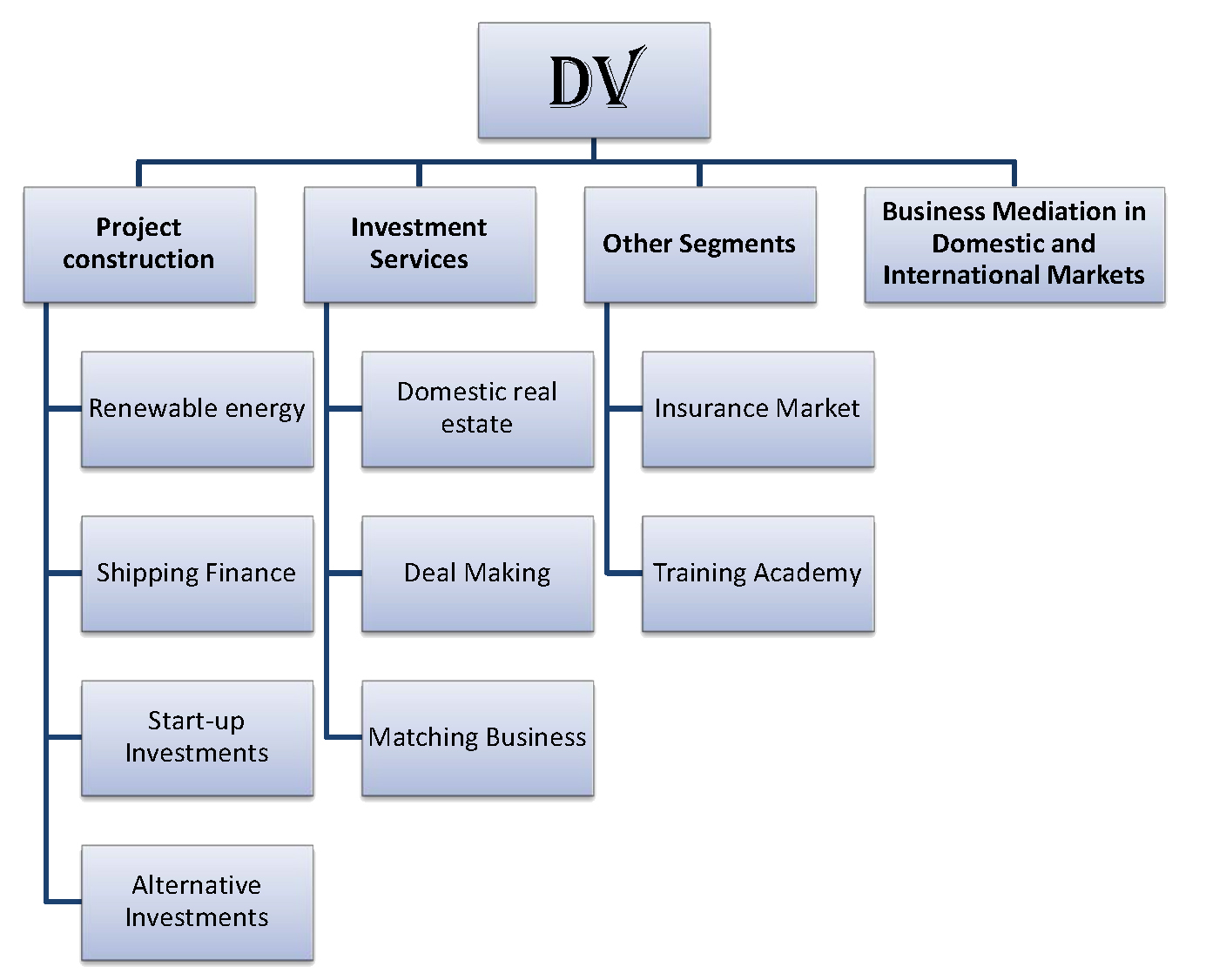

We offer to our clients and partners a broad range of services and solutions to meet the consulting and investing needs on staffing and projects.

All of our Affiliates are Reliable, Methodical, Effective and Experts in their field.

OUR VISION “prosperity & abundance”

Our Mission is the unending and sustainable development of our working creating through innovative thinking and practices.

Our Values are based on the basic Laws of our life

Mission

DV aims at developing financial solutions that fulfil the investment needs of our clientele through integrity, professionalism and trust. We put our clients come first in all the stages of our relationship and endeavor to meet their expectations at every opportunity. DV is fully committed to a client focus which allows us to deliver financial solutions aligned with customer’s values and objectives.

Competences

DV is able to draw from a large pool of experience and knowledge. As part of the financial world, we recognize and understand the opportunities and specific concerns of our clients. We are committed to looking after their financial interests by developing products that achieve this goal. Our experienced team has worked for some of the top financial institutions throughout Europe and has brought that level of competence to DV.

We are proficient in numerous financial areas including Treasury Services, Capital Markets, Structuring and Financial Engineering, Asset Management, Portfolio Management, Financial Analysis and Risk Management which enable us to develop and structure investment opportunities as well as consulting in all areas relating to investment strategy, Financial Modelling risk appetite and appropriate duration.

Structured Products & Financial Engineering

The financial landscape is continuously evolving and with these changes new investment opportunities come. From conservative to aggressive, Structured Products can complement diversified portfolios by providing efficient market exposure and risk/return profiles to institutional investors, family offices and high net worth investors. Structured Products give investors the opportunity to take advantage of individual market views and capitalize on perceived market trends to achieve desired economic benefits.

Structured products’ greatest value lies in their flexibility. We can tailor a pay-out structure of a product to meet almost any investor’s unique investment risk/ reward tolerance. Pay-out structure complexity can range from the simple, “plain vanilla” zero-coupon bond to the more complex payment structures of alternative investments.

Private Equity

DV understands the challenges that many businesses face being able to fund the growth of their business.

These issues include how to fund

- The organic growth of a business or to acquire new fixed assets.

- The acquisition of a business so as to increase revenue streams and increase market share through expansion.

Diversification into other profitable niches or the improvement of economies of scale

Partnership Intermediation

New start-up investment funds, family offices, trusts, high net worth private individuals and small to medium size enterprises can render our services to set up new investment vehicles and new structured products in partnership.

Sometimes the best way to utilize the resources at your disposal is knowing where your weaknesses lie and creating synergies through partnerships to strengthen your overall position. DV utilizes its comprehensive network to seek the best-fit partners and best in class investment opportunities.

Such investment partnership can be very favorable when the combined competencies of the participants are highly complementary and synergetic. An added incentive is that very limited early-stage risk capital is required to establish a new investment vehicle.

DV can also introduce other experienced and reputable investors that desire participation in new investment vehicles. We can intermediate between the parties, make an analysis of where the synergies lie and what both parties bring to the table and then create and structure a financially profitable solution that brings the competencies of both parties to the fore.

ORGANIZATION OF ECONOMICAL INVESTMENTS AND BUSINESS SEMINARS

N.S.R.F. NATIONAL STRATEGIC REFERENCE FRAMEWORK (Ε.Σ.Π.Α.)

(support programs subsidized by the E.U.)

Added Value: South-Eastern Europe

- Deal Sourcing

- Networking & lobbying

- Track local trends & economic developments

- Structure tailored finance solutions according to Group risk tolerance

- Serve existing clientele base

- Broaden TCP funds investors

- Identify Regional Strategic Investment opportunities

- Single out regional Distressed Assets opportunities

- Promote TCP’s regional activities

- Intragroup Cross Selling

- Introduction of Technology & Infrastructure related potentialities